-

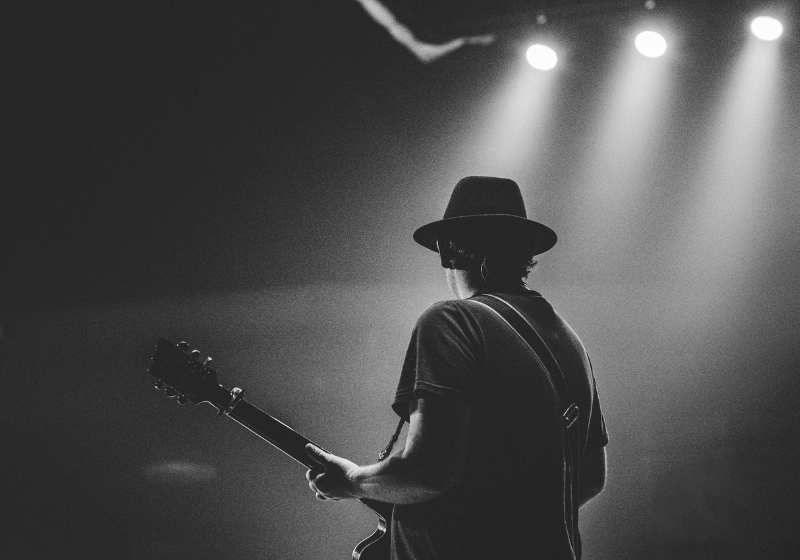

Are there tax advantages to a home studio for musicians?Setting up a home studio is a dream come true for many musicians....

-

Do simplified expenses work for your business?For many small business owners and the self-employed, keeping track of expenses can...

-

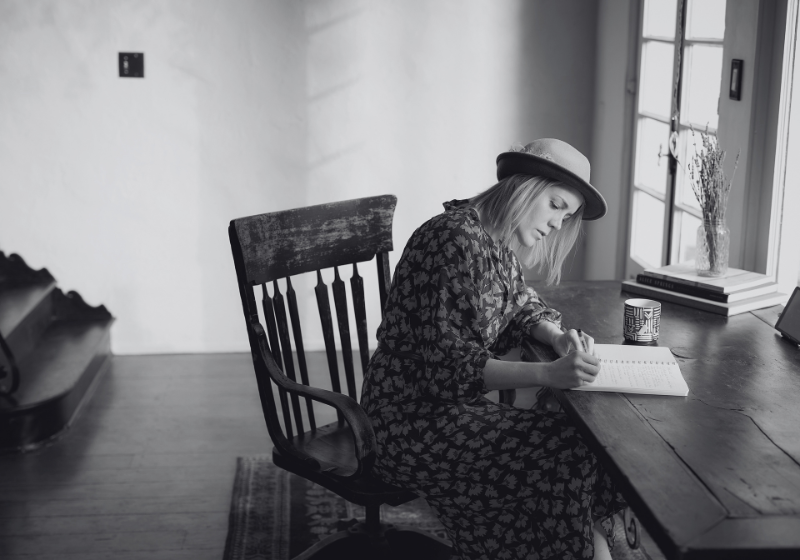

Writing your returns: What are the tax advantages for an author working from home?HMRC offers two methods for claiming home office expenses, each with its own...

-

When tax gets in-tents: What musicians can claim on tax in festival seasonThe festival season is in full swing and for musicians, it can be...

-

Knowing when your creative side hustle can become your main gigIf you’ve got a creative passion that fills your weekends (and you’re a...

-

The IR35 Labyrinth: The tax implications for actorsFor actors, the allure of the stage and screen is often accompanied by...

-

Tax management and financial advice for child content creatorsFor many parents, it’s a bewildering world. That someone so young can utter...

-

HMRC’s tax investigations – what to do (and how to avoid them)The most recent figures available show a continuing growth in HMRC tax investigations...

-

The quick guide to changes to VAT registration and deregistration thresholdsIf you’re self-employed then the freedom of being your own boss, includes organising...

-

Can the self-employed claim the costs of health insurance back from the taxman?If you’re self-employed then the freedom of being your own boss, includes organising...

-

Google Ads and VAT: It’s complicatedGoogle will bill you from Ireland for your Ads expenditure. Which makes VAT...

-

How our bill management services can help you grow your businessNo-one (apart from us) gets into business to wrap themselves up in the...

-

Keeping it in the Family: Inheritance tax mitigation for non-UK domiciled individualsFor non-UK domiciled individuals (non-doms) with significant assets, inheritance tax (IHT) planning becomes...

-

Writing a new chapter on tax efficiency for authorsFor authors, the joy of creation and publication can be dampened by the...

-

Hitting the right notes for the taxman for orchestral musiciansFor orchestral musicians, the joy of performing music can be dampened by the...

-

Keeping ahead of the trends on tax on image rights income for modelsFor those working as models or content creators in the fashion industry, it...

-

Getting the right mix for income and tax for sound engineersFor creative professionals like writers, artists, musicians, and filmmakers, intellectual property (IP) is...

-

Owning your creativity: A tax-savvy guideFor creative professionals like writers, artists, musicians, and filmmakers, intellectual property (IP) is...

-

What those in the creative industries need to know about the VAT threshold changes in the budgetThe dust, such as it was, has settled on the 2024 Spring Budget,...

-

Decoding the double life of ad revenue: tax and regulation for influencersInfluencers have a variety of income sources, but advertising, affiliate and sponsorship revenue...

-

How research for your book can unearth tax relief as well as storiesThe idea of 'research tax credits' always conjure up and image of science...

-

The realities of tax compliance for influencersWhile being a professional influencer is the kind of job that no-one would...

-

Taxes on authors’ prizes can be a lotteryIt’s probably not a plot twist that you’re going to like. Quite simply,...

-

Can you make it work as a freelance model?As we look around the office, it’s a question we often ask of...

-

There’s no ‘Vinted tax’, but side hustles can generate tax issuesFor many performers, there’s always a side hustle that gets you through the...

-

Will Hunt’s tax changes for the film industry give the glittering effect he wants?The UK government has committed to providing increased support for the creation of...

-

Navigating tax matters: a guide for actors and actresses in the UKBeing in the spotlight as an actor or actress comes with its own...

-

Could working in your pjs mean you pay more tax?If you’re one of the millions of people who have had no option...

-

Who needs to submit a self-assessment tax return?While this might not be much consolation, HMRC have projected that there will be 32.3...

-

5 great benefits to filing your tax return earlyYou may not know but a whopping 11.1 million people submitted a tax...

-

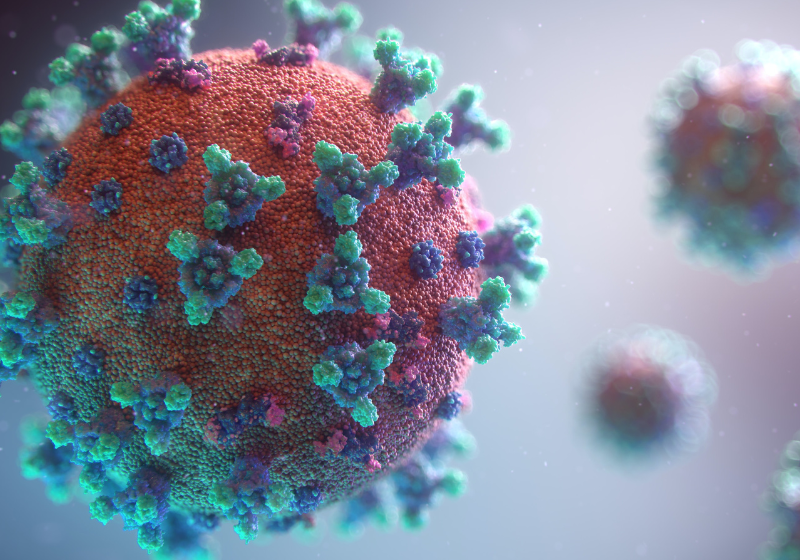

What impact has COVID 19 had on tax returns?To submit or not to submit, when, that is the question! With the...

-

What can YouTubers claim as expenses?Streaming on YouTube can be more than just a fun, creative outlet –...

-

An overview of expenses a model can claimHere at The Showbiz Accountant we work with many models and understand your...

-

What can actors claim on their taxes?As an actor, you can save a very considerable amount of money by...

-

Impact of the Government’s latest COVID 19 announcements on your taxesJust when you thought it was safe to go back into the world!...

-

An overview of expenses a sports professional can claimHere at The Showbiz Accountant we work with many sports professionals and understand your income...

-

Can actors take temporary work and still claim expenses?Well, it looks like this crazy year is not letting up. Everyone is...

-

Expenses most authors don’t know they can claim“Taxation is just a sophisticated way of demanding money with menaces.” Terry Pratchett,...

-

5 ways to earn loyal YouTube subscribersIf you’re considering building your own business as a vlogger you may want...

-

5 ways to protect your mental health for social media creatorsProtect your greatest asset – YOU! As a blogger or vlogger, you’ll be...

-

Paying taxes on a child’s YouTube channel earningsChildren can earn serious money on YouTube Anyone, can pick up a phone...

-

How to earn money on YouTubeNo expenses spared Chances are, if you’ve recently created and published a blog...

-

Could TikTok provide a platform for your talents or a lucrative income stream?Well, fellow lock-downers, I don’t know about you but I seem to be...

-

Help for the UK’s self-employed during the CoronavirusA week is a long time… Harold Wilson is credited with the famous...

-

COVID-19: What your accountant can do to help – loans & grantsCOVID-19 and what we can do to help At The Showbiz Accountant, we...

-

When to go full-time with your YouTube channelWow – if you are reading this blog as it comes out, then...

-

How can you develop the skills necessary to be a successful actor?And the Oscar goes to… Here’s the reality check my friends, research published...

-

How can you develop the skills to build a successful business through YouTube?Do you want a piece of the action? I’m sure that you already...

-

Can YouTubers claim clothing as an expense?The camera sees everything. Clothing, and looking good on camera, is an essential...

-

‘Merry Christmas Everybody!’ – or is it?Taking the terror out of tax People in the entertainment industry are often...

-

-

Should you form a limited company?The pros and cons of forming a limited company Many people working in...

-

A guide to musicians’ expensesA quick guide to expenses for musicians The excerpt above was the lament...

-

Can actors deduct travel expenses?We all know the familiar feeling of traveling to an audition. Making sure...

-

The life of a sound engineerSome sound advice… A glimpse into the life of a sound engineer Kim...

-

How actors file taxes for their side gigOnly 2% of actors make a living from acting According to a recent...

-

The pros and cons of registering for VATTo fee or not to fee …. VAT is the question! Should people...

-

What counts as self-employed income?What do you do? It’s the dreaded question at social events. The classic...

-

The dangers of a personal service companyThe dangers of using a personal service company (PSC) In a well-publicised case,...

-

Do child actors pay taxes?Working with children and animals The old adage says that actors should never...

-

Vlogging and taxVlogging: are you paying the right tax on your income and gifts? Putting...

-

Brexit and the film industryWill it leave the British screen industries out in the cold? The British...

-

Can actors claim clothing as an expense?Is clothing a deductible expense for actors? “In this world, nothing can be...

-

-

You might save money as well as timeLast year was one of the most fruitful for me as an actor....

-

Start making your money perform

Contact us for confidential advice and a no-obligation review on any aspect of accounting for people working in the entertainment industry.